Credit Restoration

Claim your free credit consultation today!

Claim your free credit consultation today!

is Cornelius Financial Solutions right for you?

How We Can Assist You

Mistakes in credit reports happen a lot and can be tough to find. Some mistakes break the rules but might seem fine on your report. We know how to find these mistakes and have a way to help you fix them.

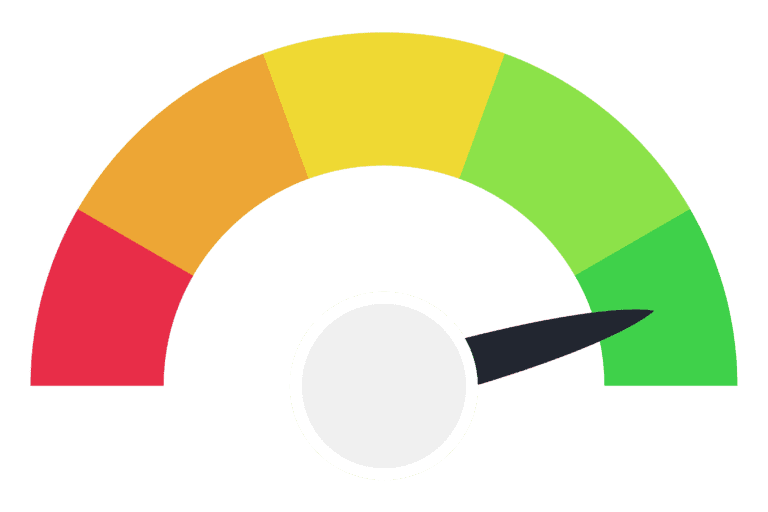

If you want to make your credit scores better, we can help. Getting your credit score up can be tricky, and the fixes might surprise you. We can tell you what things to do to get the most out of your credit scores.

How We Cannot Assist You

We don’t have a fix for real debts. Fixing credit isn’t a substitute for settling genuine collections. If you’re struggling to pay bills or dealing with debt collectors, Cornelius Financial Solutions isn’t the right choice for your situation.

If you’re dealing with genuine debt problems, put your efforts into finding a solution before thinking about credit repair.

Your Credit Restoration Journey

The Consultation

When you connect with Cornelius Financial Solutions, you’ll team up with an experienced professional dedicated to helping you achieve the credit score you deserve. This expert will thoroughly explain the steps needed to improve your credit rating, making sure you understand the process every step of the way. Additionally, they’ll craft a personalized plan designed specifically for you. This tailored approach ensures that your credit scores accurately reflect your financial history and analysis, giving you the best possible representation of your creditworthiness.

The Analysis

Our Analysis is a detailed report that pinpoints any potential issues reflected in your current credit report. We’ll carefully go through this report together, examining each line to spot inaccuracies or outdated details. Then, we’ll strategize and create a plan of action to address these issues effectively.

The Decision

As our consultation wraps up, we’ve addressed the details of your credit analysis and answered all your questions. Should you choose to move ahead with us to restore your credit, you’ll join us as a valued client. Your decision matters, and we’re here to support you every step of the way in improving your credit health.

Continuing as a client

As A Client

After joining us as a client, we conduct a comprehensive analysis of your entire credit history. This audit meticulously identifies any differences among the three credit bureaus and compiles a detailed report. This report sets the stage for the next steps in fixing any discrepancies as part of the credit reconstruction process.

As a client, you’ll gain access to a wealth of resources, education, and opportunities aimed at enhancing your understanding of credit matters. Additionally, you’ll have the chance to establish new credit avenues. We’re committed to providing you with the tools and knowledge necessary to help you build a stronger credit foundation.

Client Portal

Inside our client portal, you’ll find your credit reports and scores readily available. You’ll enjoy the convenience of real-time updates on the progress we make.

Client Account

Creating an account on our website grants you access to a range of benefits: educational resources, opportunities to build your credit, and a treasure trove of information to support your financial journey.

Credit Education

We offer an introductory course divided into three modules, providing a solid start to understanding credit. Additionally, our comprehensive credit education program spans across twelve modules. These modules cover various aspects in detail, offering a thorough and in-depth understanding of credit-related topics. Whether you’re looking for a quick overview or a deeper dive into credit education, we’ve got you covered with these structured courses.

Credit Opportunities

Within your access, you’ll find a selection of secured credit cards, unsecured credit cards, and credit building loans available for you to apply. Additionally, we provide access to specific credit building programs, all designed to assist you in establishing or enhancing your credit. With these options readily accessible on our site, you can explore and choose the best-suited credit-building opportunities to help strengthen your financial foundation.

Get Started Today!

Sign up in 90 seconds to start restoring errors on your credit report and boosting your score.

We handle your information with the highest level of care and respect, just as we would with our own. Safeguarding your data is a top priority for us, ensuring that it remains secure and protected throughout our interactions.

FAQ

Credit Restoration

In addition to our commitment to removing negative and inaccurate information from your credit report, we equip you with valuable information and knowledge to boost your credit score. Moreover, we offer programs designed to help you gain mastery over your finances.

The Fair Credit Reporting Act (FCRA), Fair Credit Billing Act (FCBA) and the Fair Debt Collections Practices Act (FDCPA) afford you the legal right to dispute inaccurate items on your credit reports with the credit bureaus and your individual creditors.

Absolutely, Check out our DIY webpage. You could hire us for the convenience of dealing with the headaches working with the credit agencies and your creditors.

We provide you access to your own client portal where you will see all of your information including Scores, Dispute Status and details, all correspondence sent on your behalf, plus resources to assist for a complete financial restoration.

Our Single Plan is $89.99 monthly and our Couple Plan is $149.99 monthly

Not at all, If you live together and your finances are mingled we invite you both to sign up and will give you the discount!

We stand behind our work and if we fail to get any items deleted from your credit report within 180 days, we will give you a full refund of all fees you have paid to us. The burden of risk falls on us 100%

You would either send a message from the client portal, by email or phone.

Nope, since we do not have service contracts, there are no surprise charges!