Request A Free Consultation!

Request A Free Consultation!

Our Solutions

Credit Restoration

Credit Restoration

Our comprehensive Credit Restoration services do more than just dispute errors on your credit report. We work diligently to examine your credit history, pinpoint areas for improvement, and create a tailored plan to maximize your credit potential. We provide offers, tools, and programs to make the most of your good credit and build new credit.

Restoration Overview

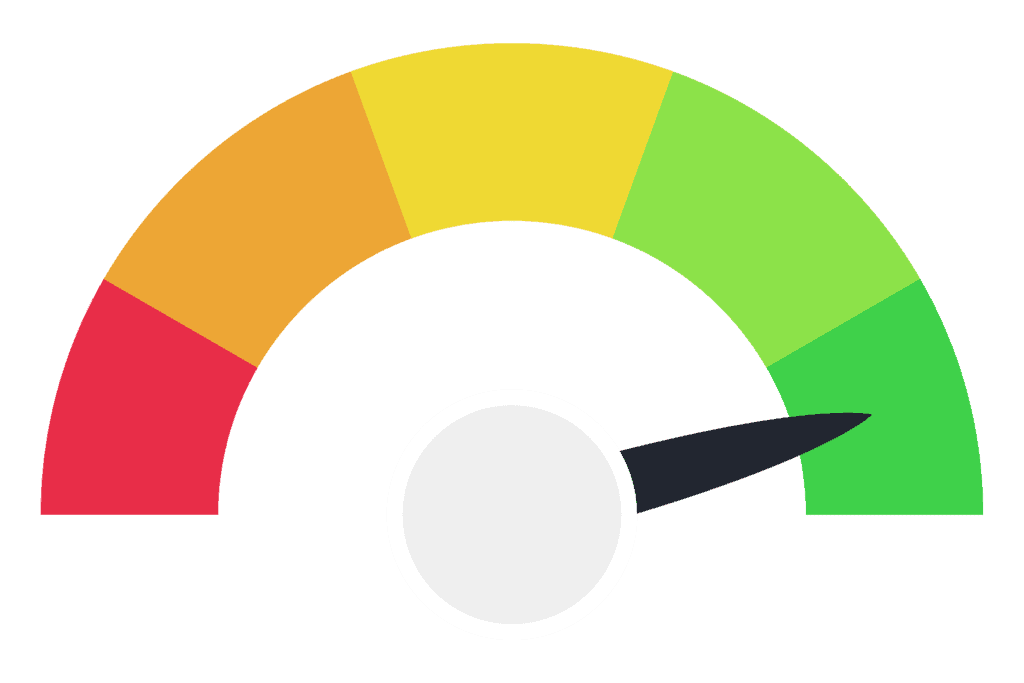

Through the use of smart negotiation tactics with credit bureaus, creditors, and collection agencies, combined with our expertise, our aim is to remove any incorrect, inaccurate, or outdated information that might be hurting your credit history. As a result, we help you improve your credit score, sometimes in as little as 3 months.

Credit Education

Upon completing our Credit Education program, you’ll not just gain a deep grasp of credit but also the abilities to use it wisely in order to reach your financial objectives. Whether you’re aspiring to purchase a house, launch a business, or just gain command over your finances, our program is your ticket to unlocking a realm of possibilities.

For Our Clients

We place a high value on being clear and openly communicating with you. Our experienced team will keep you updated all the way through the process, making sure you understand every move we make toward your credit repair objectives. We are dedicated to equipping our clients with the information and resources required to make well-informed financial choices.

Income Management

Income Management

Income Management is the foundation of financial success, empowering you to take control of your financial future. It begins with getting organized. Start by gathering all your financial data – your income sources, expenses, debts, and investments. This meticulous collection of data provides a clear picture of your financial landscape.

Create A Plan

With this information in hand, the next step is to create a comprehensive financial plan. Establish your goals, whether it’s saving for a dream vacation, buying a home, or retiring comfortably. Your plan should outline a roadmap for achieving these goals, taking into account your income and expenses.

Stick To The Plan

But having a plan is only half the battle; the real challenge lies in sticking to it. Discipline and commitment are key here. Avoid impulsive spending, stay within your budget, and resist the temptation to deviate from your financial plan. Regularly review your progress to ensure you’re on track to meet your goals.

For Our Students

Are you ready to take control of your finances and maximize your hard-earned income? With our expert coaching and a proven budgeting strategy, we’ll guide you on a transformative journey towards financial success. Our 4-step Money Management System is designed to help you unlock hidden potential in your finances, putting money back in your pocket.

Student Loan Resolution

Consolidation

Student loan consolidation is like gathering all your debts into a single manageable package. When you consolidate your student loans, you merge multiple loans into one new loan with a single monthly payment, ideally with a lower interest rate. This process simplifies your repayment journey, reducing the hassle of keeping track of various loans and due dates.

Lower Payments

Income-Driven Repayment (IDR) plans are a game-changer for graduates navigating student loan repayments. These plans tailor your monthly payments to your income, potentially slashing your payments significantly. By considering your earnings and family size, IDR plans cap your monthly repayment at a manageable percentage of your discretionary income.

Rehabilitation

Student loan rehabilitation is a pathway for borrowers who’ve fallen behind on payments to mend their financial standing. It’s a chance to hit the reset button on defaulted loans by committing to a manageable repayment plan. When entering rehabilitation, you agree to make a series of affordable, on-time payments for a consecutive period, typically nine months.

Loan Forgiveness

Student Loan Forgiveness stands as a beacon of hope for borrowers facing the weight of substantial student debt. It offers a pathway to alleviate or eliminate part or all of the outstanding loan balance, granting relief after meeting specific criteria. There are various forgiveness programs tailored for different professions, including public service, teaching, healthcare, and more.